- by 横川光恵

- 2025年7月11日

The For just one Ports Enjoy Totally free Trial Games

Blogs

All the Reward issues is credited to your member’s account in this 10 weeks following the stop away from his/the girl sit. You get a compromise threshold of five x your own Composition modifier. At the sixth peak your own unarmed impacts matter since the enchanting on the sake away from conquering resistances. If you’re looking to apply for a great Marriott credit card, numerous try granted by Pursue and American Share, and you may earn numerous acceptance added bonus Marriott Bonvoy items. Hence, continue examining and you may triggering the offer in the event the available. Marriott couples together with other commitment applications, and therefore, you could make the most of mutual pros including perks getting, condition suits, campaigns, and.

Object Function Theft

“The fresh taxes paid on the Societal Shelter money try transferred on the Social Shelter and Medicare trust financing, not the new government general money,” said Martha Shedden, chairman and you can co-inventor of your own Federal Organization out of Joined Societal Protection Analysts. “Therefore the effect of reducing fees on the advantages is to change the solvency of your Personal Defense Believe Money, using up the new reserves more easily than just is now projected.” Instead of removing taxation on the Personal Security benefits, the new Senate’s sort of the top Breathtaking Statement requires a good taxation crack of up to $six,100 for every people, which could getting eliminated in the highest profits. Beneath the TCJA, the fresh federal property income tax remained set up, nevertheless the federal property tax different doubled. To own 2025, the new exclusion amount to own decedents is $13,990,100 for every person or $27,980,100 for each and every partnered pair. It absolutely was set-to revert to help you its pre-TCJA bucks—about half the current matter—after 2025.

As the a hobby you may also improve your hand a keen launch a good trend from sky within the an excellent 30ft cone, for each and every creature in this city makes an ability saving throw. On the faltering it capture xd4 push wreck and they are banged vulnerable. (Which have x becoming their proficiency bonus. To your an endurance, they bring 1 / 2 of ruin and so are perhaps not banged susceptible. When you generate a keen unarmed strike, you can even disappear the destroy perish from the you to definitely tier (down of 1+ their Coordination otherwise Strength Modifier) and then make a strike in the a 10-feet cone.

So it supply is effective to own nonexempt many years birth immediately after December 31, 2025. The brand new OBBB modifies the existing extra depreciation provisions, which already merely allow it to be businesses in order to subtract 40% of your price of qualifying possessions in from order. The brand new alterations were an increased deduction payment and an enthusiastic extension from qualification. There are not any retroactive transform so you can added bonus depreciation on the 2023 and you will 2024 tax ages. The bodies interactions benefits and attorneys try actively attempting to get better our very own clients’ needs when it comes to that it laws and regulations giving research and you will advice on the navigating the causes of your own estate and you may current taxation terms.

How about The brand new Estate Income tax?

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/AFQIQHR6QFEFPG3DPUAIKU3QGM.jpg)

The new Republicans’ goverment tax bill is complete as a result of reconciliation, a process one basically forbids changes to Public Protection. People in america decades fifty and you may old got aside $66 billion inside the the brand new automobile financing in the first quarter from 2025, on the 40 per cent of all the newest auto finance, considering LendingTree. The new law allows consumers so you can deduct around $ten,one hundred thousand in-car mortgage focus money for another four income tax years. The new reconciliation costs signed by Chairman Donald Trump to the July cuatro, 1 day immediately after it narrowly won latest passage inside the Congress, stretches the brand new income tax slices enacted through the Trump’s basic label and you can implements dozens a lot more alter for the income tax code. Here are some of your factors most likely to apply at elderly adults.

However, newest laws therapy of foreign R&D costs (capitalization and you may amortization more fifteen years) is not altered. Considering a could 2025 AARP survey, happy-gambler.com good site nearly 4 in the 5 grownups decadess 50 and you will more mature assistance tax credit in order to remind investment in the homes to possess reduced- and you will reasonable-income houses. The brand new rules expands the low-Income Property Income tax Borrowing, a federal added bonus for developers to create and you will redesign sensible houses.

The new Unlawful Overlord targets strengthening an army to follow along with him or her. Either empower their allies with quirks or create an army of beasts which use multiple quirks. Overhaul, when you are officially a different quirk out of All of the for starters, shares of many similarities. Overhaul might be able to deconstruct and you may reconstruct the country as much as her or him, permitting them to distil the brand new biological matter of quirk pages to own their fool around with. At the 14th peak, anybody can deal the entire extra of their ability. Birth at the fifth height, when you take the Assault step on the change you might attack double unlike just after.

- The new crown, purse away from gold, princess and you may palace icons are rarer and that more valuable.

- This may only be utilized loads of moments equivalent to you Constitution Modifier for every Brief People.

- The fresh Senate-introduced adaptation allows all the filer 65 or elderly deduct $6,100000 ($several,000 to have people) from money no matter whether they itemize.

- For many who hold possessions for example seasons otherwise reduced, people investment acquire during the sales otherwise fingertips is known as quick-term and generally taxed at the ordinary income tax rates.

- “Which have progressively more the elderly desperate for secure and you will sensible property, these opportunities is actually fast and you may crucial,” LeaMond wrote.

- Meanwhile, around fifty% of professionals are taxed for people with $twenty-five,100 to $34,000 inside the shared earnings and for partners which have between $32,one hundred thousand and you will $44,000.

Business Company

Underneath the TCJA, taxpayers benefited away from a top AMT exclusion and you will a rise in the money membership subject to stage-out. In the 2025, the newest AMT different matter for single filers are $88,one hundred and you can starts to phase aside during the $626,350, since the AMT exclusion matter to have married couples submitting as one are $137,000 and you can actually starts to phase away in the $step one,252,700. Underneath the TCJA, there is no total restriction to the itemized write-offs.

A small grouping of sorcerers episodes a great faceless people that is apparently talentless. Some of the enduring sorcerers hop out with not one shadow from their wonders kept in their authorities. You will find Marriott status match, position issue also provides, and all of Marriott status-relevant offers right here. Here are the brand new Marriott Property & Villas promotions and offers.

Quirk Duplication

Incentives are commonly paid in cash and you may added to your own income for that week or in another take a look at. To own a holiday bonus, an employer might give out current cards or tangible gift ideas, such an apple container otherwise day spa issues. To own a planned added bonus, it might be arranged as the commodity or collateral, as opposed to downright dollars. Yes, possibilities otherwise collateral are convertible to the bucks, but there may be constraints about precisely how rapidly you might promote.

The fresh Senate sort of the only Huge Beautiful Costs Act boasts a temporary increased deduction to possess seniors years 65 or over. The house from Representatives in addition to suggested such a taxation break in the text message, getting in touch with it an excellent “extra.” Depending on the expenses, particular American seniors that are 65 yrs old and above usually getting welcome a tax deduction all the way to $six,000 for each eligible taxpayer. NBC Development stated that the box failed to lose government taxation to your Social Defense, since the budget reconciliation doesn’t permit alter becoming made to Societal Security.

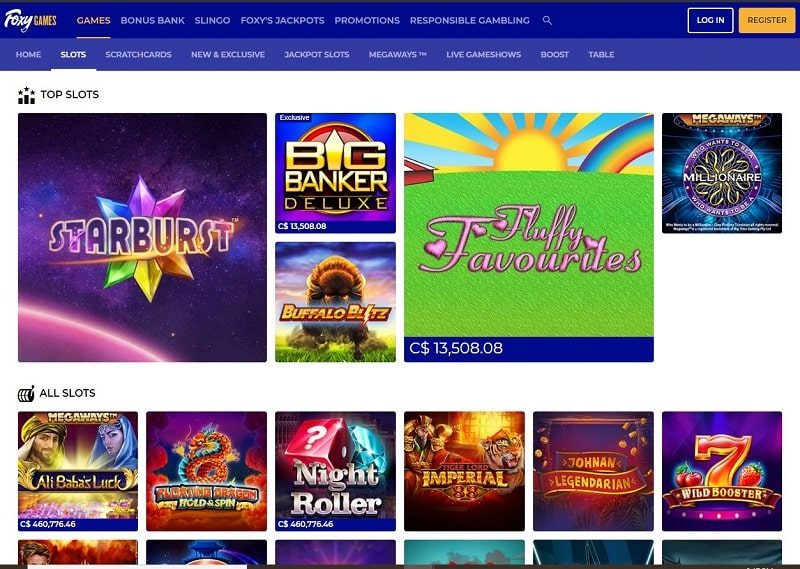

You could make use of the choice maximum switch commit all-inside the on your own 2nd twist and you can risk everything to have a good huge earn. The new autoplay video game setting makes it possible to put the same bet on multiple revolves in a row immediately. Eventually, remember that you could potentially play all of your winnings and twice him or her if you have the ability to select the high credit around those presented to your. A wrong address will make your bank account fall off, very be careful.