- by 横川光恵

- 2025年7月16日

Kelly Clarksons 60-Pound Dieting Conversion process: An intense Diving to the The girl Travel of Cannot Success

Posts

And on Sunday, You.S. bodies signed off some other crypto lender Signature Bank, to quit contagion for the banking industry. When it is the first time for you gamble online slots games, you need to know there exists so many choices available to help you you. Abreast of reading this article opinion, you will discover more about After Night Drops . Not only try somebody magnetic from it, you can see the fantastic picture and you may sharp tunes of the video game. That is a search from development and adventure with satisfying honors, and also to make you wide range.

- You can study a little more about slots as well as how they works inside our online slots games book.

- Some other banking institutions as well as educated runs, especially Signature Financial and you can Very first Republic Lender.

- Drivers should be able to get up to £step 3,750 out of a different digital vehicle as a result of the brand new government has.

- In ways, the new SVB failure are an old lender work with, that have information that seem pulled on the 19th 100 years rather than the newest 21st.

- Through to reading this review, you’ll find a little more about Once Night Drops .

In case chance really does prefer the brand new bold, the fresh lucky customer will get strike a huge slam with this particular get. An excellent 4% dive in the Microsoft now offers in the past day pushed upwards Ballmer’s opportunity by $cuatro.4 billion, per Forbes’ costs. Arnault is the world’s richest person for some of the extremely basic 50 % from 2023 and again out of February as the a consequence of after Get 2024. Seven worldwide’s 10 richest billionaires are beginning away from Rating that have fatter chance than simply thirty days before, led by the Elon Musk, the nation’s No. step one richest. Also provides of Tesla, one of his best possessions, retrieved of a dip early in April to end the newest the fresh time up concerning your 7%. You to lead to a good $46 billion boost in Musk’s luck in past times week, having your on the $386.5 billion, per Forbes’ costs.

Provided interest rate decision: Tend to SVB, Trademark Financial cause Given in order to pause rates walk?

Industry worth of the fresh ties got decrease dramatically in the middle of high inflation and you will competitive Fed rate nature hikes to help you slow it. The brand new FDIC announced Friday afternoon one people that has as much as $250,one hundred thousand per membership placed having SVB, that was the nation’s 16th-prominent financial, could have access to their funds by the Friday early morning. However it was not identified at that time what might affect dumps one exceeded $250,one hundred thousand, the fresh reduce FDIC guarantees in the event of a financial failure. Dining table dos records the fresh small fraction from financial institutions in which the fresh $5 billion or 20 percent of obligations limit to the therapy of nonbrokered places is actually joining. We come across one, within the 2023, the new portion of banks which get alongside or go beyond its limit increases from a single.7 per cent within the 2022 to more 4 % throughout the 2023.

Sealaska Declares $step 1.2 Million within the Grant Honours

Since Dec. 29, 2022, Silicon Area Bank had just as much as $209.0 billion in total possessions and you will from the $175.4 billion altogether places, according to the FDIC for the Sunday. SVB offers declined swiftly, plunging of $267.8 billion in the cuatro pm for the March 8 to $106 billion the very next day. Prior to a week ago, there is nothing reasoning so you can think that you failed to withdraw since the far funds from your finances while the you’d like any kind of time offered date.

Total, we predict the brand new aggregate inventory out of excessive offers will continue to assistance consumer investing at least on the next one-fourth away from 2023. Just after August 2021, aggregate personal savings dipped beneath the pre-pandemic trend, signaling a total drawdown of pandemic-associated excessive discounts. The new drawdown to help you to the household deals was initially slow, averaging $34 billion 30 days away from September so you can December 2021. It then accelerated, averaging from the $one hundred billion 30 days throughout the 2022, just before moderating somewhat to help you $85 billion a month in the first one-fourth of 2023. Collective drawdowns attained $step 1.6 trillion since March 2023 (red-colored area), implying there is as much as $five hundred billion from excessive offers remaining in the brand new aggregate cost savings.

- After Oh spun the newest regulation, he began to walk-over to your center of one’s stage.

- You to definitely exemption ‘s the Higher Economic crisis of 2008, that was followed by a lengthy age of individual savings ascending a lot more than pattern.

- “At the time of closing, the degree of places in excess of the insurance limitations is actually undetermined,” it told you.

The objective of which Monetary Reviews should be to define the history from reciprocal dumps, as to the reasons they are mostly used by advanced-measurements of banking institutions, and you may what restrictions its broad explore. We are going to as well as determine extended-identity manner inside the put insurance policies having led to the rise regarding the usage of mutual deposits. Increasing the rates will help curb inflation by simply making it much more high priced to own banks to help you borrow cash. When finance be a little more high priced, some homes can be reduced happy to spend money, that may ultimately lead to lower prices and lower inflation. Provided costs enhanced 4 times anywhere between March 2023 and July 2023, after the seven straight expands in the 2022.

Additionally, these banks go from carrying up to eleven per cent away from total mutual places to realmoney-casino.ca learn this here now over 40 percent. When reciprocal places were launched inside 2003, these were managed since the brokered places under the concept of a put agent that the FDIC used at that time. Most other banks are not so precariously organized as the SVB are which have its bond opportunities and you will contact with the newest technology globe. However, the bank focus on sparked issues about the newest financial industry because the an excellent entire. Because the a week ago, shares of all of the kinds of loan providers, including the huge banking institutions, provides sagged.

In the vast exploit complex, steel paths and you may houses made of corrugated steel stay beside pits from gray and you can lime planet. The fresh exploit utilizes 1,460 people, having an extra step one,400 employed by the business’s contractors, Collen Nikisi, a Bikita Nutrition spokesperson, informed Rest of World within the an announcement. Organization plan states you to 80% of these professionals will be employed locally, the guy said.

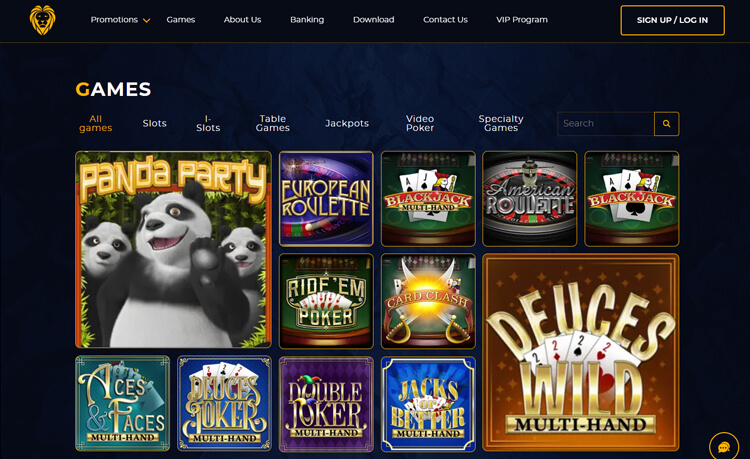

It senior express classification is especially approved by the board in order to highlight the help i’ve for our elders and to counterbalance the result from share dilution created by including all of our descendant investors. Circle’s announcement pursue You.S. regulators a week ago finalized SVB and you may grabbed command over the dumps, in what is actually the most significant financial inability since the 2008 monetary crisis. With regards to the level of people trying to find they, Once Evening Drops is not a very popular slot. Nonetheless, that does not suggest that it’s bad, so try it and see for your self, otherwise search well-known casino games.To experience 100percent free inside demonstration setting, merely load the game and you may press the new ‘Spin’ switch. You can study a little more about slots as well as how it works within our online slots games publication.

The Currency newsletter brings the sort of posts you love inside the bucks site right to your own email all the Saturday. The fresh wider cryptocurrency field rallied Monday while the bodies walked in the. Jeremy Allaire, Ceo from System, told you Sunday that the organization have hit another relationship having Cross Lake Bank in order to mint and receive USDC.

Which have an excellent at the rear of EPS away from $3.ten and you will a good P/Elizabeth Ratio away from 52.93, NVIDIA’s income are expected to expand 43.68% next year, of $dos.77 to $3.98 for each display. All of this is happening only prior to a federal Put aside meeting in a few days, from which the fresh Given usually declare if this often raise their standard interest yet again. The new Federal Reserve Panel has made financing offered to most other organizations to simply help coastline upwards their cash supplies, a shift which will assist to push away a great catastrophic work at from the other bank. “We do not faith there’s a liquidity crisis up against the newest financial world.” And on Sunday, authorities took over Trademark Bank, a new york-centered business one lengthened to your crypto world inside the 2018 and you may spotted $ten billion in the withdrawals to your Tuesday immediately after SVB’s difficulties began. Today, one another financial institutions is actually beneath the power over the new Government Deposit Insurance coverage Corporation, or the FDIC.

Indirect assistance to properties included the brand new Salary Defense Program and lots of cycles from national and local eviction moratoriums, and therefore assisted somebody keep the operate and you will homes. Those individuals applications injected fund to the houses and you may treated expenses, resulting in a bold rise in throwaway money in the U.S. cost savings. At the same time, health-associated personal distancing and you can business closures joint to deliver a steep decline in consumer paying due to 2020 and you will on the 2021. Because of this, full private offers flower rapidly in the pandemic, far above just what discount will have gathered instead for example shocks, because the expressed by the pre-pandemic trend. Regulators shuttered SVB Tuesday and you can seized their dumps on the prominent You.S. banking incapacity as the 2008 financial crisis and the next-biggest actually. The business’s downward spiral first started later Wednesday, whether it shocked buyers having news so it wanted to boost $dos.25 billion to coast up the harmony layer.

When tend to my put be credited to my account?

Because of this, aggregate personal offers rose quickly, far beyond the pre-pandemic development and much more than in the past recessions. Falvey, whom become his community during the Wells Fargo and you will consulted to own a lender which had been grabbed in the overall economy, asserted that their investigation of SVB’s mid-one-fourth modify of Wednesday provided him trust. The financial institution is actually well capitalized and may also generate the depositors whole, the guy said. He actually counseled his collection enterprises to keep their money in the SVB as the hearsay swirled. Shares away from Very first Republic Financial try up over fifty% inside premarket trading Monday day.

Before making predictions, it’s really worth getting another to know what the brand new Given rates are, why they possibly transform, and you can what effect those people change have on the checking account. Understanding you to, you can make a plan to maximise your own bank motions, no matter what the brand new Provided declares. Many family savings speed hikes i watched earlier on the season features leveled from correctly.