- by 横川光恵

- 2025年10月30日

Understanding Forex Trading Charts A Comprehensive Guide 1936616188

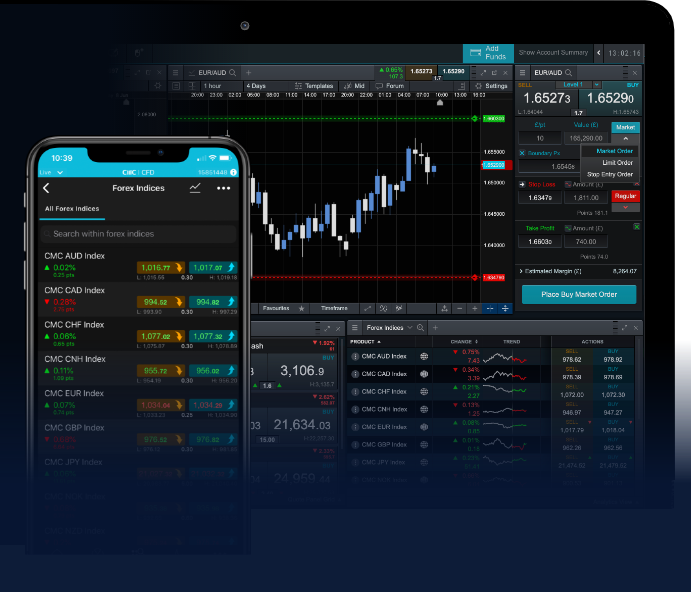

Understanding Forex trading charts is crucial for anyone looking to navigate the complexities of the foreign exchange market. From beginners to seasoned traders, mastering chart analysis can significantly improve trading outcomes. Whether you’re trading individual currency pairs or exploring various trading strategies, a solid grasp of chart patterns and indicators will offer an essential advantage. For further insights and tools, visit forex trading charts https://forex-exregister.com/.

What Are Forex Trading Charts?

Forex trading charts visually represent price movements of currency pairs over a specified period. These charts are the fundamental tools traders use to analyze trends, determine optimal entry and exit points, and make informed trading decisions. The primary types of charts used in Forex trading include line charts, bar charts, and candlestick charts.

Types of Forex Charts

1. Line Charts

Line charts provide a simple representation of price movements by connecting closing prices over time. They are particularly effective for observing overall trends in price movements, but they lack the detailed information offered by other chart types.

2. Bar Charts

Bar charts present more data than line charts, displaying the high, low, open, and close prices for a specific time period. Each bar represents a single time interval, illustrating a range of price movement. Experienced traders often favor bar charts for their detailed insights.

3. Candlestick Charts

Candlestick charts combine the visual appeal and information density of both line and bar charts. Each candlestick represents a time interval, illustrating the open, high, low, and close prices in a more accessible format. The body of the candlestick is colored to indicate whether the price has risen or fallen during that time frame, making it easier to identify market sentiment and potential reversals.

Key Components of Forex Charts

Understanding various components of Forex charts is essential for effective analysis:

1. Timeframes

Forex charts can display data in various timeframes, from one minute to monthly. Short-term traders often focus on minute and hourly charts, while long-term traders may analyze daily or weekly charts. The chosen timeframe can significantly impact trading strategies.

2. Trendlines

Trendlines are straight lines drawn on a chart that connect significant price points. They help traders identify the direction of the market (upward, downward, or sideways) and potential support and resistance levels.

3. Support and Resistance Levels

Support and resistance levels are horizontal lines drawn on the chart at prices where the market has historically reversed direction. These levels serve as critical indicators for traders regarding potential entry and exit points.

How to Read Forex Charts Effectively

Reading Forex charts requires practice and familiarity with key concepts. Here are some tips to enhance your chart-reading skills:

1. Identify Trends

Recognizing market trends is the first step in effective chart reading. Determine whether the market is trending upwards, downwards, or moving sideways, as this influences your trading strategy.

2. Analyze Patterns

Look for specific chart patterns such as head and shoulders, triangles, and flags. These patterns often indicate potential future price movements and can provide hints regarding entry and exit points.

3. Use Technical Indicators

Integrating technical indicators, such as moving averages, Relative Strength Index (RSI), and MACD, can provide additional confirmation of price movements and enhance your analysis.

Common Chart Patterns in Forex Trading

1. Head and Shoulders

This reversal pattern consists of three peaks: a higher peak (head) between two lower peaks (shoulders). It indicates a potential reversal of the current trend.

2. Double Tops and Bottoms

Double tops appear as a peak followed by a subsequent peak at a similar price level, indicating potential resistance. Conversely, double bottoms signal a potential reversal from a downtrend to an uptrend.

3. Triangles

Triangles form when price movements converge between two trendlines. Depending on the direction of the breakout, they can indicate continuation or reversal of the current trend.

Importance of Forex Charts in Trading Strategies

Integrating Forex trading charts into your trading strategy is vital for several reasons:

1. Decision-Making

Charts provide essential data that enable traders to make informed decisions regarding entry and exit points, capital allocation, and risk management.

2. Emotional Control

Understanding price movements through charts helps traders maintain emotional discipline. Relying on data-driven insights reduces the temptation to make impulsive decisions based on fear or greed.

3. Risk Management

By identifying support and resistance levels, traders can better manage risks by placing stop-loss and take-profit orders strategically.

Conclusion

Mastering Forex trading charts is an invaluable skill for traders of all levels. With practice and the right tools, you will enhance your technical analysis capabilities, improve decision-making processes, and ultimately become a more successful trader. Whether you are just beginning or looking to refine your strategy, investing time in understanding how to read and analyze Forex charts can lead to better trading outcomes.